Termination of Benefits Coverage

If you and/or your eligible dependents have health insurance coverage with Dexian, coverage will run through the end of the month in which you terminate for medical, dental & vision benefits. If you have remaining paychecks payroll will continue taking deductions to cover your premiums for medical, dental and vision for that month only. Any additional group benefits are terminated on the day of termination. Please see the termination schedule of benefits. If you have any questions or unresolved issues, please contact the Dexian benefits center at (855) 645-2545.

How to Elect COBRA Benefits

Dexian partners with Flores to administer COBRA Continuation.

- If you or your dependents are enrolled in a COBRA eligible plan (i.e. medical, dental or vision) you will be offered COBRA continuation rights.

- Each person covered by the benefit at the time of termination has individual rights to elect COBRA. You may elect to temporarily continue coverage under coverage. You can elect COBRA for none, some or all of those who were covered on the plan while covered as an active employee. If elected, benefits begin on the first day following the loss of coverage.

- It could take up to 44 days for you to receive your COBRA packet in the mail following your date of termination. Once your letter is sent you can contact Flores for log in information and elect coverage online.

Please keep in mind elections must be made within 60 days.

If you have any questions or would like to check the status of your COBRA continuation package, please contact our COBRA administrator Flores at 800-532-3327 or visit www.flores247.com.

401(k) Retirement Savings Plan

You are the “owner” of all of your own 401(k) contributions, plus any share of company match contributions in which you are vested. Log into www.Principal.com to complete the online forms.

- Rollover or Cash out: You may move the vested balance of your 401(k) account to another qualified employer’s 401(k), an IRA, or you may take it as taxable income. Please wait to start this process until after you receive your last check, including commission payments.

- Vesting: Employer match contributions are fully vested after three years of service (YOS). YOS is defined as 1,000 hours or more worked in a calendar year.

If you do not rollover your 401(k) funds within a year of leaving Dexian:

- Account balances above $7,000 can stay in the Dexian 401(k) plan.

- Account balances under $1,000 will be cashed out and mailed directly to your address on file with Dexian.

- Account balances between $1,000-$7,000 will be rolled over to an IRA with Retirement

Transit, Parking, and FSA Dependent Care

- Payroll contributions end with last paycheck.

- Expenses incurred on or before your termination date are reimbursable by contacting Flores. Reimbursement claims must be filed before March 31st of the year following termination.

- Questions regarding Transit, Parking and FSA Dependent Care? Please contact Flores at 1-800-532-3327.

Health Saving Account (HSA)

If you have an active Health Savings Account, you will retain access to all funds in that account. There is no “use or lose” option on the account.

Note: If you make HSA contributions in the same year to multiple employers, you need to track your annual contribution amounts as employers only know what you have contributed with them. Refer to the IRS website for additional details on eligibility and/or contribution limits.

Proof of Credible Coverage

Following employment separation with Dexian, our carriers will generate a certificate of credible coverage showing that coverage has ended. This letter will be mailed to you.

If you have not received the certificate of credible coverage in the mail and/or need documentation sooner, please follow the below steps to obtain proof of coverage for medical, dental or vision:

- If you need proof of coverage for medical, please visit the following link with United Health Care to request documentation: Proof of Coverage or Proof of Lost Coverage.

- If you need proof of coverage for dental, please contact Guardian Dental’s Customer Care by calling (800) 541-7846.

- If you need proof of coverage for vision, please contact VSP Vision Customer Service by calling (800) 877-7185.

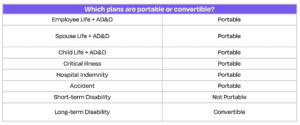

Continuation of Voluntary Benefits

Several of our voluntary benefit plans are portable following employment separation. This means that even after you separate employment, you can continue to enjoy the benefits offered by these plans.

Nationwide Pet

Upon employment separation, you can still keep your furry family members healthy and happy. Simply move your Nationwide pet insurance policy payments from payroll deduction to direct bill—and keep the peace of mind that comes with knowing your pet is always protected. Please contact customer care at 800-540- 2016 if you have any questions.

LegalShield

As a LegalShield member, you can continue coverage after ending employment and keep your current price and benefits. Contact LegalShield at 1-888-807- 0407 or mail the payment form linked below within 45 days of you last day of employment, otherwise your coverage will automatically cancel.

The Hartford Notice of Conversion and/or Portability Rights

Following loss of coverage, you will receive a notice of conversion and/or portability rights (“Notice of Conversion and/or Portability Rights”) from The Hartford that informs you of your right to exercise the Portability, Extended Continuation or Conversion option(s) of their Group Life, Supplemental Life, LTD, Critical Illness, Accident, Hospital Indemnification contract (“Group Policy”) issued by The Hartford (“Service”).

How do I make my benefits portable or convertible?

The notice you will receive is part of a 3-step process to obtain coverage. To be eligible to start this process, your employer representative sends you a signed notice no later than 90 days after the Group Coverage Loss Date. If your notice is signed prior to the Group Coverage Loss Date, the employer signature date will be the same as the Group Coverage Loss Date for Steps 1 and 3 in the outline below.

Examples of Loss of Coverage

Includes an event such as loss of your employment; the end of continuation coverage; membership in an eligible class; coverage decreased through an age reduction; etc. See group policy for additional details (Dexian Basic Life Plan Doc)

How do I make a decision?

To decide whether Portability or Conversion is the right choice for your personal situation, you need to understand the differences. Visit www.hartford-employee-guide.com to view the complete side-by-side comparison table. You may also obtain a copy of this comparison by calling 1-877-320-0484.

Instructions & Timeline

To ensure that you effectively manage the transition of your voluntary benefits following employment separation, please review the below timeline.